Understanding Contribution Margin in Ecommerce: What It Is, What Impacts It & How to Improve It

Join Sean Clanchy, MD of Swanky APAC, as he unpacks what contribution margin means for ecommerce brands, why it matters, and which factors impact it the most. You’ll also find seven practical strategies to help you improve contribution margin and grow your business more sustainably.

Written By

Sean Clanchy

In ecommerce, profit margins can feel razor thin. Rising ad costs, fluctuating shipping rates and growing competition make it challenging for retailers to sustain healthy returns. Whilst top-line revenue is important, what ultimately matters is how much of that revenue contributes to covering fixed costs and generating profit. This is where contribution margin becomes a critical metric.

Contribution margin goes beyond gross profit. It highlights the profitability of each order after variable costs are deducted – acting as a decision-making compass for pricing, promotions, product strategy and marketing.

In this article, we will:

- define contribution margin in plain terms;

- explore the key factors that impact it, with a focus on ecommerce; and

- share actionable strategies, complete with examples, for retailers who want to strengthen their contribution margin and build more profitable online stores.

What is contribution margin?

Contribution margin is the portion of sales revenue that remains after variable costs are deducted. It shows how much money is available to cover fixed costs like salaries, software subscriptions and office rent – and beyond that, to contribute to profit.

The formula is simple:

Contribution Margin = Net Sales – Variable Costs

Consider the following example to help provide context.

Imagine you sell a product for £100.

Your variable costs include:

- £40 product cost (from the supplier)

- £10 shipping

- £3 payment processing

- £2 packaging

- £20 allocated marketing spend

These total £75.

Your contribution margin is therefore £25 per order (£100 – £75).

This means that for every sale, £25 is left to cover your fixed costs and profit.

Why contribution margin matters for ecommerce retailers

Understanding contribution margin isn’t just about crunching numbers – it’s about gaining the clarity you need to make smarter, profit-focused decisions across your ecommerce business.

Here are four core reasons why this metric should be on your radar as an ecommerce retailer.

- Pricing clarity: It gives a true sense of whether products are priced correctly relative to costs.

- Smarter decision-making: It guides choices around discounts, promotions and advertising spend.

- Profit-first thinking: It prevents you from chasing high sales volume on products or channels that don’t actually contribute to profit.

- Sustainable scaling: Understanding how much each sale ‘contributes’ ensures growth doesn’t just increase revenue, but also profit.

Contribution margin & business pivot points

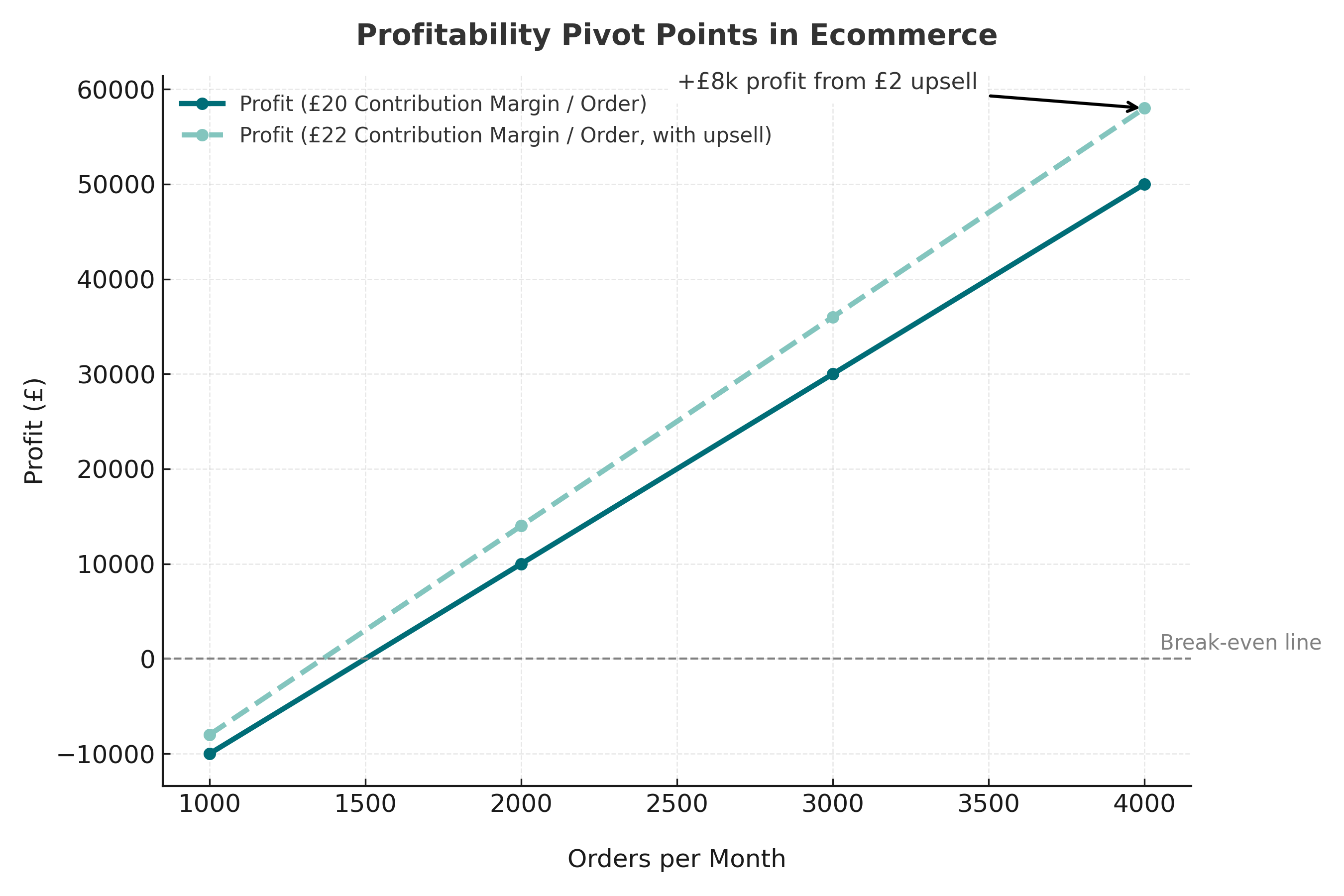

One of the most powerful applications of contribution margin is its ability to reveal pivot points in your business – the moment where you cross from loss-making into profitability – and how quickly returns can accelerate beyond that point.

For example, imagine a scenario where a retailer operates with fixed costs of £30,000 per month (a warehouse lease plus five staff salaries). These costs remain the same whether they ship one order or 10,000.

They currently process 1,000 orders a month, with each order contributing £20 in contribution margin. Total contribution margin is therefore £20,000. Against £30,000 in fixed costs, the business is running at a monthly loss of £10,000.

If they were to sell 2,000 orders per month, contribution margin doubles to £40,000. Now the business would cover its fixed costs and generate a £10,000 monthly profit.

By 3,000 orders, contribution margin climbs to £60,000, equating to £30,000 profit (or £6,000 profit per FTE per month).

At 4,000 orders, contribution margin hits £80,000, delivering a £50,000 monthly profit (£10,000 profit per FTE per month).

As you can see, once you pass that profit pivot point, every incremental sale drops through at a much higher rate because your fixed costs are already covered. The unit economics improve rapidly – as long as your fixed costs stay the same.

To avoid fixed costs rising in lockstep with order volume, automation and efficiency are key. By streamlining fulfilment, order management and customer service, you can grow without adding equivalent overhead. This will help your profitability accelerate past the pivot point.

Modelling the impact of upsells

Now consider the impact of something as modest as a £2 upsell at checkout. If every order contributes £22 instead of £20, the pivot points shifts dramatically and the business will break even with fewer orders:

- 1,000 orders = £22,000 contribution margin = £8,000 monthly loss

- 2,000 orders = £44,000 contribution margin = £12,000 monthly profit

- 3,000 orders = £66,000 contribution margin = £36,000 monthly profit

- 4,000 orders = £88,000 contribution margin = £58,000 monthly profit

That seemingly small upsell drives an extra £8,000 profit at 4,000 orders.

Contribution margin allows you to model these upsell scenarios clearly, quantify the impact of even minor changes, and make more confident decisions about scaling.

Modelling the impact of larger business decisions

The concept of pivot points also provides a useful framework for evaluating bigger strategic decisions, such as hiring new staff, investing in a new warehouse or expanding into a new market.

Each of these decisions typically introduces a significant increase in fixed costs. By applying contribution margin analysis, you can calculate the pivot point at which these investments pay back. In other words, how many additional profitable orders are needed to cover the new fixed cost before the decision starts to add real value?

This approach ensures that each decision is held accountable to profitability. By documenting the cost/benefit analysis in advance, you can set realistic targets, measure performance against them, and avoid scaling into unprofitable territory.

Factors that impact contribution margin in ecommerce

Several factors affect contribution margin, but some carry particular weight for ecommerce retailers:

- Product costs (COGS): Perhaps one of the most obvious factors is the wholesale or manufacturing cost of your product. Some SKUs naturally have better margins than others, making your product mix a key driver.

- Shipping and fulfilment: Rising courier fees, international shipping complexity and 3PL pick-and-pack charges all impact contribution margin. Offering free or heavily discounted shipping without careful planning can erode profitability quickly.

- Payment processing fees: Transaction costs from payment providers can eat into revenue. Encouraging customers towards lower-fee methods can help preserve margin.

- Marketing and customer acquisition costs (CAC): For many ecommerce brands, ad spend is the single largest variable cost. The more you spend to convert each order, the thinner your contribution margin. Influencer fees and affiliate commissions can also have an impact.

- Returns and refunds: High return rates eat into net sales and create additional handling costs. This is particularly pertinent in the fashion category, which has the highest return rates across all ecommerce categories, sitting at around 24%.

- Packaging: Branded or sustainable packaging enhances customer experience but typically adds to variable costs.

- Discounts and promotions: Heavily discounted sales campaigns reduce contribution per order.

- Average Order Value (AOV): Higher AOV spreads variable costs more efficiently across each order, while lower AOV can leave you fighting for volume to stay profitable.

7 strategies to improve contribution margin

Next we will consider a range of practical strategies that ecommerce retailers can use to strengthen contribution margin. Thinking back to the formula shared earlier, at a basic level lifting contribution margin is about increasing net sales and reducing variable costs.

Each approach shared below balances cost control with pricing and customer experience, ensuring that profitability grows without undermining brand value.

1. Optimise your pricing strategy

- Re-evaluate pricing regularly: Supplier costs, courier charges and exchange rates rarely remain consistent. Carrying out regular product pricing reviews prevents you from quietly absorbing rising costs. Even a small price increase, if well justified, can protect margins without noticeably affecting customer demand.

- Value-based pricing: Instead of fighting purely on price, lean into your brand’s unique selling points. If your product is sustainably made, sourced from high-quality ingredients or materials, or backed by excellent service, customers will often accept a slightly higher price point. This helps protect your margin from commoditisation.

- Smart discounting: Blanket site-wide markdowns may spike volume, but often devastate margins. Instead, we recommend using discounts strategically – think product bundles, tiered rewards or targeted new-customer offers. This allows you to capture demand without training your entire audience to expect perpetual discounts.

Example

A skincare brand decides to raise its prices by 5%. On its own, this could risk alienating price-sensitive customers. However, the brand pairs this increase with stronger value messaging to reassure customers and reinforce why the products are worth the extra cost.

They launch a multi-channel content-led campaign, highlighting the benefits of their high-quality, all-natural ingredients and the superior results that customers can expect when compared to cheaper alternatives. Packaging and product pages are also updated with clearer storytelling about sourcing, organic status and health outcomes – making the value proposition more tangible.

As a result, the conversation shifts from price to quality and impact. Customers accept the price increase because they understand the benefits of the product. Net sales value and contribution margin improves, without any drop in demand.

2. Reduce product & supply chain costs

- Negotiate supplier terms: Whether through bulk ordering, long-term contracts or simply building stronger relationships, many suppliers will be open to offering improved terms that lower your variable costs and directly lift margin.

- Pivot from reselling: Brands that manufacture their own versions of bestsellers often achieve significantly better contribution margins than resellers. Private label products let you control both costs and pricing.

- Review and rationalise your product portfolio: Not every SKU needs to be kept if it isn’t profitable. Analysing contribution margin at the product level helps you identify which items earn their place and which may be quietly draining resources. We talk more about this later in the article.

Example

A supplement retailer makes the decision to discontinue a low-margin SKU that drove 10% of sales but tied up inventory space and marketing spend.

By re-allocating resources towards a flagship product with a 40% higher contribution margin – supported by stronger promotional focus and better stock availability – the brand simplifies operations and sees overall profitability improve, even without replacing the lost sales volume.

3. Improve shipping & fulfilment efficiency

- Set free shipping thresholds strategically: If your AOV is £45, for example, setting your free shipping threshold at £60 could encourage customers to add extra items to their carts. This lifts average basket size and spreads your fulfilment costs over more revenue.

- Compare fulfilment models: For some brands, 3PLs offer economies of scale that lower per-order costs. For others, in-house fulfilment may prove leaner. Regularly reviewing your fulfilment setup helps you find the best balance as you look to reduce variable costs.

- Consider passing partial costs to customers: Flat-rate or zone-based shipping can reduce the burden on your margins while keeping the customer experience predictable.

Example

A home and lifestyle ecommerce brand raises its free shipping threshold from £50 to £75. Instead of deterring customers, this change encourages shoppers to add more to their baskets in order to unlock free delivery.

As a result, the brand sees AOV climb, which increases contribution margin per order. Meanwhile, fulfilment costs become more sustainable.

4. Increase AOV

- Bundles and kits: Consider bundling related products together at a small discount. These pre-curated product bundles offer convenience to customers, saving them decision-making time, whilst increasing perceived value. Meanwhile, this strategy can increase basket size and improve your contribution margins. After we implemented product bundling for international retailer DockATot, AOV increased by 15% month-on-month. Learn more about leveraging product bundling for increased AOV.

- Upselling and cross-selling: Recommending complementary items on product pages or in the cart is a popular strategy for increasing AOV. Framing these recommendations as helpful suggestions keeps the tone customer-centric, gently encouraging customers to take action.

- Tiered incentives: Rewards such as loyalty points, free samples or complimentary shipping can gently nudge customers towards adding more to their carts. Even a £5 lift in AOV, multiplied across thousands of orders, can significantly increase overall profitability.

Example

A petcare ecommerce brand adds a “frequently bought together” module to product pages, recommending items like treats, grooming accessories or supplements alongside the main purchase. The convenience of one-click add-ons resonates with customers, who see value in stocking up on complementary essentials in a single order.

As a result, AOV increases from £43 to £51. Because COGS remains unchanged on a per-item basis, contribution margin per order grows significantly, giving the brand more profit from the same number of transactions. Furthermore, this simple addition also enhances the shopping experience for customers, making it easier for them to discover relevant products.

5. Control marketing & acquisition costs

- Peer-to-peer referrals: Referral programs harness the trust customers place in their friends. They often deliver higher conversion rates at a fraction of paid advertising costs. By rewarding both referrer and referee, you create a cycle that lowers CAC whilst reinforcing brand advocacy.

- Invest in conversion rate optimisation (CRO): Increasing your ecommerce site’s conversion rate means generating more revenue from the same amount of traffic – thereby lowering CAC. Changes that you could consider A/B testing on-site include reducing checkout fields, changing CTA (call-to-action) wording, or adding user-generated content for social proof. Every incremental uplift in conversion rate reduces the average cost of acquiring a customer. Find out more about Swanky’s CRO services.

- Grow owned channels: Paid ads can be expensive and volatile. Building strong, personalised email and SMS programs gives you a direct, low-cost route to engage customers and drive repeat purchases – reducing your reliance on paid campaigns. This lowers long-term CAC and improves the margin contribution of each order. Learn how to create impactful email automations in our guide to mastering Klaviyo flows.

You can read more on this topic in our guide to reducing customer acquisition cost.

Example

A beer subscription brand launches a referral program, offering discounts for both referrers and referees. Loyal subscribers are quick to share with friends, who already trust their recommendations and are more inclined to convert.

Within six months, 18% of new customers come from referrals at near-zero acquisition cost. This dramatically lifts contribution margin across the board. At the same time, the referral scheme strengthens the brand’s sense of community, as existing customers feel recognised and involved in the brand’s growth.

6. Reduce returns & refunds

- Boost purchasing confidence: Providing detailed product descriptions, accurate size guides and product videos can help to reduce customer uncertainty and lower return rates. Furthermore, an increasing number of retailers are embracing AI-driven fit recommendations to drive confidence in consumers, especially in the fashion industry.

- Encourage exchanges over refunds: Offering store credit or an instant exchange can help retain revenue while still resolving the customer’s issue.

- Invest in try-before-you-buy (TBYB) solutions: Another way to reduce the need for returns in the first place is with TBYB tools, which allow shoppers to experience and evaluate products at home before committing to a purchase. These solutions have also been shown to increase AOV and reduce consumers’ use of discounts. We recommend Try With Mirra, a platform-agnostic TBYB solution that reduces purchase risk whilst driving key ecommerce metrics.

We talk more about strategies like these in our article on ecommerce returns management.

Example

A footwear brand implements AI-powered sizing recommendations on its product pages. These help shoppers choose the right fit based on data such as past purchases, body measurements and peer reviews.

This added layer of confidence significantly reduces the guesswork that often leads to costly returns. Within months, the brand sees return rates drop from 30% to 18%, saving £8 per order in reverse logistics, restocking and wasted packaging.

By cutting avoidable costs and improving the customer experience, the brand protects its contribution margin whilst also building greater trust and satisfaction among shoppers.

7. Leverage technology & analytics

- Track contribution margin at SKU and channel level: More than just a financial calculation, contribution margin is a lens through which retailers can make smarter, more strategic business decisions. Monitoring this metric at product, channel and campaign level provides sharper insights than just tracking revenue or gross profit. At a product level, it highlights hero SKUs and flags which items are lowering your margins. In terms of marketing, it reveals which channels are genuinely profitable, empowering marketers to shift spend to those that deliver value. At a wider business level, tracking contribution margin ensures that growth decisions are based not just on revenue, but on sustainable profitability.

- Use predictive tools: Analytics platforms can model how pricing or fulfilment changes will affect margins before you commit. This allows you to test scenarios without risk.

- Automate operational processes: From inventory management to order routing, automation helps to reduce human error and streamline costs that typically erode contribution margin.

Contribution margin in ecommerce: A final word

Contribution margin is a telling indicator of business health. It measures how much revenue from each sale is left after covering variable costs, and it helps retailers understand what they truly keep from every pound, dollar or euro earned.

By optimising pricing, reducing supply chain costs, improving fulfilment, raising AOV, lowering acquisition costs, minimising returns and using technology wisely, brands can steadily improve their contribution margins.

Ultimately, when understood and managed effectively, this powerful metric helps brands shift from selling more to selling smarter – and build lasting profit in a competitive market.

Discuss your ecommerce strategy with a Shopify Platinum Partner

Want to continue the conversation around contribution margin? Our team of trusted Shopify experts would be happy to discuss any of the themes in this article with you, including key ecommerce metrics, strategies for increasing AOV and tactics for reducing CAC.